*DEAL ALERT – NNN Medical Office Space

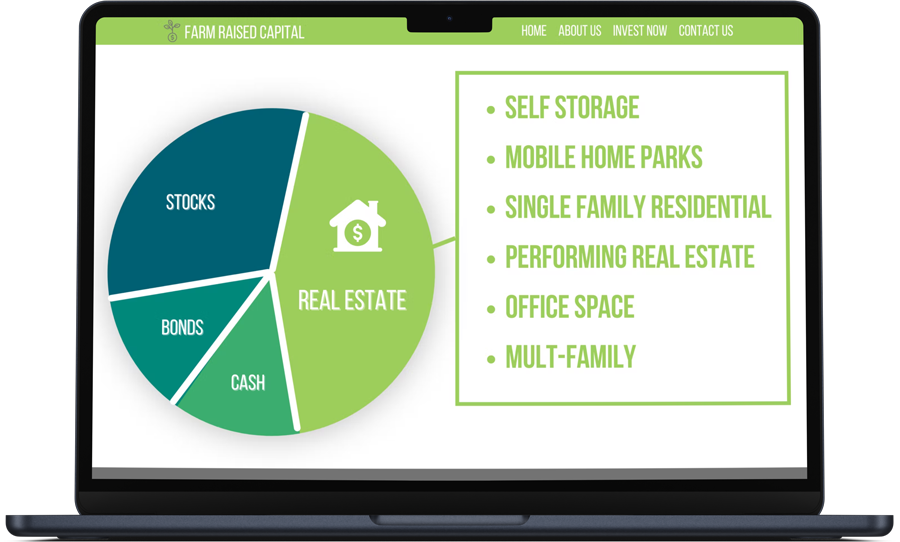

Farm Raised Capital is excited to bring you a unique investment opportunity in medical real estate. With a focus on healthcare and dental offices, this asset class offers long-term leases and recession-resistant tenants, providing a stable foundation for consistent returns. Medical real estate is positioned to grow alongside the increasing demand for healthcare services, making it a smart addition to any diversified portfolio.

Click below to learn more

Review Investment Opportunity