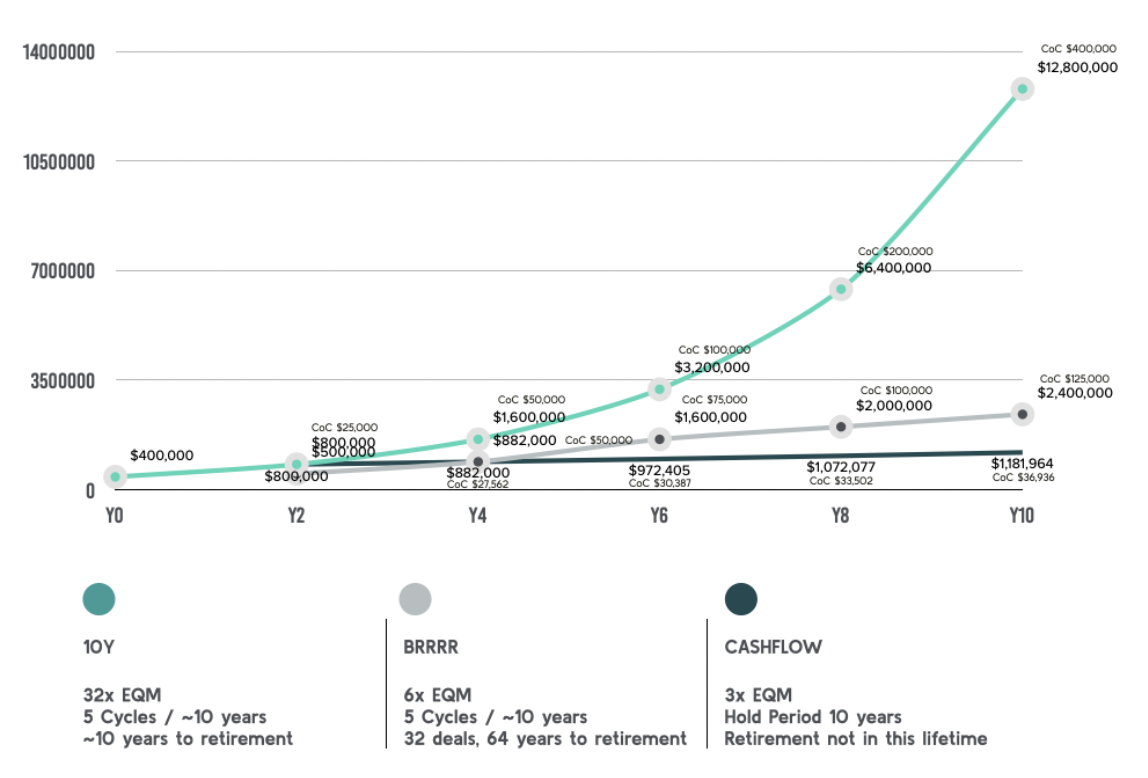

Challenging Conventional Investment Models

Getting You To Retirement in 10 Years

We are excited to announce a partnership with 10Y, a real estate investment firm whose approach challenges traditional investing methods with one simple goal… Your retirement in 10 years.

Through a one-time investment and simple execution, the 10Y methodology delivers exponential returns that dwarf the traditional cash flow investment models.

Please enjoy our investor webinar recording.